Review Platform Intent Data: A Tool for Marketing & Sales Success

Many organizations are adding intent data to their marketing and sales toolkit to help identify prospects and improve conversion rates. Knowing who your potential customers are can help to fine tune campaigns for better results. Intent data helps identify companies that have higher potential to be in a buying journey. In a 2020 Demand Gen Benchmark Study, 51% of B2B marketers reported that they were using intent data to improve the quality of their demand generation efforts. Gartner predicts that by 2022, this number will increase to 70%.

There are many types of B2B intent data providers to choose from. In our latest guide, we explore why review platform intent data is one of the best kept secrets for tech marketing. Review platform data offers visibility into the companies researching you and your competitors. Not only does this offer invaluable insight into who’s in the market right now, it’s also highly actionable across marketing and sales teams. In this post, we’ll explore how review platform intent data differs from other types of intent data, and why it’s a powerful tool for tech marketers.

What are the different types of intent data?

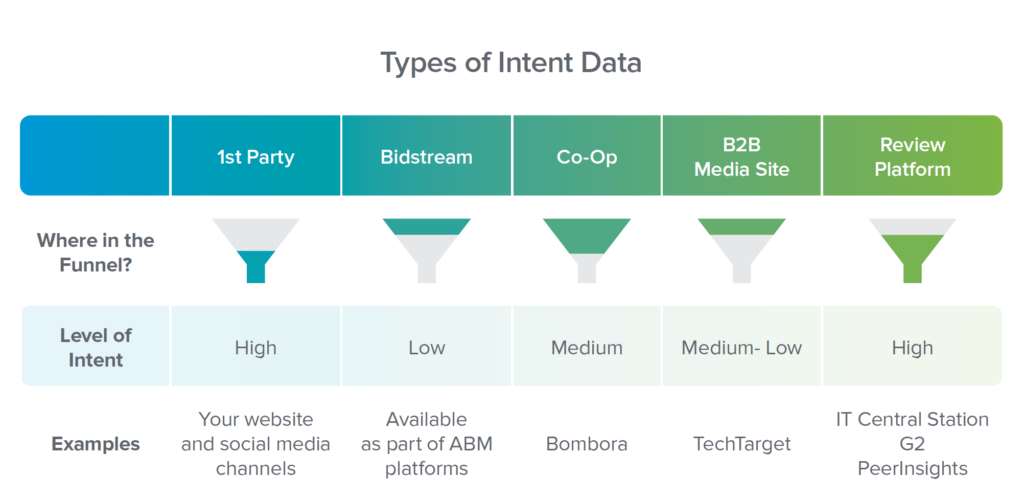

There are many ways to categorize the different types of intent data. Some just split it between 1st and 3rd party data, while others refer to 1st, 2nd, and 3rd party data. We like to differentiate between the types of data based on how it is collected, as this contextualizes the level of intent, the quality and where in the funnel the data sits. According to this approach, there are 5 major categories:

- 1st Party Data

- Bidstream Data

- Co-Op Data

- B2B Media Site Data

- Review Platform Data

Each of these types of intent data has benefits. Understanding the basic differences will help with understanding what makes review platform intent data unique. It will also help with picking the providers that will help meet marketing and sales goals. You don’t need to choose just one provider – sometimes, the most effective strategy will incorporate multiple data sources.

First Party Data

First party data is the data produced from your own digital sources. This includes the actions that prospects and clients take on your website, emails and social media channels. First party data will often reveal prospects who are in advanced stages of the buying journey (and bottom of the funnel) and poised to make a purchase. This is very strong data which can feed into lead scoring and ABM marketing campaigns.

First Party Data is very powerful, but it comes with some limitations. Firstly, it’s limited to the people who are already looking at you, so you’re missing out on catching prospects who are still in the awareness and consideration phases. 70% of the buyer’s journey is complete before a prospect contacts sales. Additionally, you only get a partial view of a prospect’s research process. If you know what other sites they’re visiting, this can help to fill in the blanks (for example, are they researching your competitors? This demonstrates high intent). This is why companies typically combine 1st party data with other intent data sources, often through an ABM platform, like 6sense, DemandBase and Terminus.

Bidstream Data

Bidstream data is used to infer the intent of companies based on ads that their employees click on. This type of data is collected using an ad pixel that’s shared through ad exchanges with biddable ad space. ABM platforms often use this as part of their offering.

While bidstream data offers high volumes and broad coverage, this is also where its weakness lies – it casts the net a little too wide. Typically, the data is considered low quality and high funnel. Bidstream data has also come under fire for non-compliance with privacy regulations and fraudulent data, and is under scrutiny by the US Senate amid privacy concerns.

Co-Op Data

Co-Op data is sourced from a group of publishers and websites which pool data together so that they can all have access to a larger data set. Co-Op data providers collect data points from their network across the web. They then provide aggregated data showing the level of interest that companies are showing in a particular topic.

Co-Op data boasts high accuracy in determining interest in a particular topic, which purportedly indicates high buyer intent.

A limitation of Co-Op data is that most of the sites they collect data from are based on articles about a wide range of topics. Whilst the data may indicate a high level of interest from a company in a particular topic, it’s not a guarantee that they’re ready to buy. Consequently, the data often reflects topical interest rather than buyer intent, and is considered top to middle of the funnel. This can result in a high degree of false positives.

B2B Media Website Data

Media companies like TechTarget and IDG have large audiences in the B2B space. Their content mostly revolves around thought leadership that is attractive to a broad audience. Some sites also host forums for users who are conducting product research, which provides stronger intent signals than sites that have only article content.

These companies sell their 1st party data as intent data, with the premise that interest in a particular topic will indicate intent to buy. Although this may be true to some extent, tech buyers aren’t necessarily on their platforms to research a purchase – they are more likely there to read interesting articles, learn and stay up to date on industry trends. This means that the data is more top- to mid-funnel.

Review Platform Data: High Intent and High Accuracy

As mentioned before, each type of intent data has its benefits. Bidstream, Co-Op, and B2B Media Website data demonstrate differing levels of accuracy in predicting buyer intent. Overall, the level of intent of each of these types of intent data is top- to middle-of-funnel. There may also be cases where the companies identified are actually further along in their buyer’s journey – but how can you identify those companies?

Review platform intent data providers like PeerSpot offer a particularly compelling solution. Intent data from a review site consists largely of high intent buyers who are at a critical stage of the buyer’s journey – they’re in the decision phase, and almost ready to make a purchase.

How do we know this? According to a recent report, almost 70% of the B2B buyer’s journey is done before a prospect ever contacts sales. In addition, in DemandGen’s 2021 B2B Buyers Survey Report, the majority of respondents indicated that they sought input from peers or existing users as the final step before accepting outreach from a vendor and engaging with a sales representative from the vendor they had selected.

We have also seen evidence of PeerSpot site visitors being in advanced stages of the buying journey. In a recent survey that we conducted among App Security visitors to our site, 86% of the respondents said that they were planning a project in the next year.

Think about it:

A user arrived on the review site through a Google search for information about a product. People don’t read complex product reviews just for kicks – they are looking for help in choosing what product to buy. B2B buyers who are about to spend a lot of money on an enterprise solution want to know what their peers’ experiences have been with the solutions they’re considering before making a purchase.

Because review sites have this highly targeted, homogenous audience whose main logical use case for a review site is researching a purchase, all the site visitors exhibit a degree of intent. Unlike other types of data, this intent data is low funnel and has a high degree of accuracy because there is no guesswork involved. The intent data generated by a review platform shows you exactly which companies are researching you and your competitors.

Driving Marketing & Sales with Review Platform Data

Intent data is only as powerful as what you do with it. The problem is that, often, companies don’t know what to do with intent data. In a 2020 TOPO report, 67% of companies reported that their biggest challenge with intent data is making the data actionable.

Because review platform data is bottom-funnel, marketers and sales teams can use the data in a variety of ways. In our Essential Guide to Review Platform Intent Data, we give tips for different ways that review platform intent data can be used. For example, the marketing department can use the data to update lead scoring, plan targeted campaigns, and build and refine ABM lists. The sales team can use the data to prioritize accounts, reduce churn and identify opportunities to expand accounts.

Conclusion

Review platform intent data offers a unique opportunity to see what your prospects are researching right now – and to tailor your marketing and sales activities accordingly. Integrating these practices into your existing processes can take time, and requires planning and buy-in from your team. Done right, it will make an impact across your organization.