AI Changed How Buyers Research. It Didn’t Change How They Decide.

AI and large language models have fundamentally reshaped how B2B buyers discover software. Research happens faster. Shortlists form earlier. Buyers arrive informed, opinionated, and often deep into evaluation before they ever engage a vendor.

For marketers, that shift raises a critical question:

If AI is shaping discovery, where does real buying intent actually form?

The answer sits later in the journey than most teams expect.

What Changed in B2B Buying Because of AI?

AI has accelerated the research phase of the buying journey.

Buyers now use LLMs to:

- Explore categories independently

- Compare vendors at a high level

- Narrow options before engaging sales

- Form early impressions without vendor input

Discovery has moved upstream and become automated.

But discovery is not decision-making.

See how buyers move from AI research to decision →

Why Validation Still Determines the Outcome

Final decisions still carry risk.

Budgets are constrained. Switching costs are real. Internal alignment matters. When buyers reach this stage, they slow down.

Validation happens later in the funnel, where confidence matters more than information.

By the time a buyer reaches out to a vendor under consideration:

- 70% of the buying journey is already complete (6sense)

- 78% have defined their requirements (6sense)

- 81% have a preferred vendor in mind (Gartner)

At this point, buyers are no longer exploring what exists. They are validating a direction they have already chosen.

That shift fundamentally changes what marketing influence looks like.

Why AI Prefers Advice Over Ratings

This is where AI fundamentally changes the rules.

LLMs do not reason well over isolated data points. A star rating is a signal, but it lacks meaning on its own. There is no context to summarize, no nuance to extract, no tradeoffs to weigh.

Advice, on the other hand, has semantic density.

It includes:

- Use-case context

- Implementation realities

- Constraints and tradeoffs

- Recommendations tied to outcomes

This is exactly the type of material LLMs are designed to synthesize.

That is why research shows peer review platforms have become front-line influence channels in GenAI-driven discovery. They provide the structured, experience-based guidance AI systems can interpret, summarize, and surface in buyer-facing answers.

AI does not just surface opinions.

It surfaces advice that helps buyers decide.

How GenAI Shapes Buyer Perception Before You Engage

GenAI does not invent narratives. It assembles them from trusted, publicly accessible sources.

The most frequently referenced inputs in AI-driven vendor discovery include:

- Peer review platforms with long-form, experience-based guidance

- Public analyst-backed research that is accessible and indexable

- Practitioner communities and forums

- Structured third-party summaries

What matters is not branding. It is a substance.

The sources AI relies on most are the ones that provide decision-ready context, not surface-level validation.

As a result, buyers are forming impressions and narrowing options before campaigns, analyst briefings, or sales conversations ever occur.

If your brand is not present in these advice-rich environments, AI will still form an opinion. It just may not include you.

The Signal Marketers Should Actually Act On

Not all buyer behavior is equal.

Early-stage activity signals curiosity.

Evaluation-stage behavior signals intent.

Evaluation behavior shows up when buyers:

- Spend time with long-form peer guidance

- Compare advice across similar use cases

- Revisit implementation details and lessons learned

- Validate tradeoffs before committing

These are not browsing actions.

They are confidence-building actions.

For marketers, this distinction matters because timing is the mechanism.

Pipeline improves not by generating more signals, but by engaging when validation is already underway.

Turning Validation Into Pipeline, Practically

This is where execution changes.

Instead of timing outreach to awareness signals, high-performing teams align outreach to validation signals.

That means:

- Engaging buyers when they are consuming peer advice, not introductory content

- Prioritizing accounts actively comparing real-world experiences

- Reinforcing conclusions buyers are already forming, rather than introducing new narratives

When buyers finally engage with sales, research consistently shows the first vendor they contact often has a meaningful advantage. Not because they arrived early, but because they were present and credible during validation.

Marketing influence does not disappear late in the funnel.

It becomes more precise.

Capturing the Validation Phase

This is how the validation phase becomes visible and actionable.

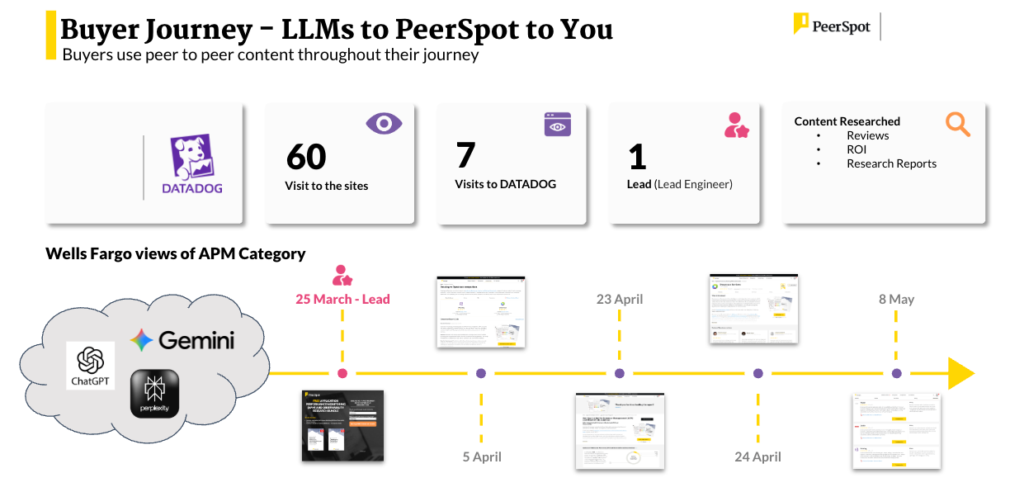

PeerSpot sits at the intersection where AI-driven discovery gives way to human validation. Its differentiation is not simply hosting reviews, but enabling deep, advice-driven peer guidance rooted in real-world experience.

Once buyers complete their initial zero-click or LLM-driven research, they do not immediately convert. Instead, they enter a sustained validation phase. On average, buyers spend approximately 2.5 months engaging on PeerSpot as they evaluate options, compare experiences, and build confidence before making a decision.

During this phase, buyers come to PeerSpot to:

- Understand how products perform in environments like theirs

- Learn about tradeoffs before committing

- Validate decisions using peer advice, not vendor claims

Because this content is semantically rich and experience-based, it is:

- Trusted by buyers during evaluation

- Referenced across AI discovery surfaces

- Actionable for marketers aligning outreach with real buying intent

This sustained engagement creates two confidence signals teams can act on:

PeerIntent Leads identify buyers actively evaluating and comparing solutions through peer advice and category research.

Premium Site Leads identify buyers validating decisions through in-depth guidance and technical content at the final stage of the journey.

These are not volume plays.

They are timing plays.

See how PeerSpot captures buyer intent at decision time

What This Means for Execution Now

For marketing teams focused on active pipeline, the implication is clear.

Instead of chasing incremental awareness, teams can concentrate on buyers already validating decisions.

Instead of flooding sales with early interest, they can prioritize confidence signals that indicate readiness.

AI accelerates discovery.

Advice accelerates decisions.

Marketing wins by recognizing the difference.

The Bottom Line

AI changed how buyers research software.

It did not change how they decided.

Decisions are still made through trust, validation, and advice grounded in real experience. The difference is when those moments occur and how visible they are.

Marketing teams that win in the GenAI era will stop optimizing for activity and start optimizing for confidence.

That is where intent becomes clear.

That is where ROI becomes provable.

And that is where marketing has the greatest influence on revenue.